Wells Fargo Active Cash Card application opens doors to a world of financial empowerment. Unlocking this card isn’t just about credit; it’s about strategic financial planning and maximizing your spending power. This comprehensive guide navigates you through the application process, highlighting eligibility criteria, showcasing the card’s impressive features, and addressing potential concerns. Prepare to embark on a journey toward smarter financial management.

From understanding the straightforward application steps to mastering the cashback rewards program, we’ll equip you with the knowledge to confidently navigate the Wells Fargo Active Cash Card application and unlock its full potential. We’ll demystify the process, making it accessible and empowering for everyone seeking financial freedom.

Applying for the Wells Fargo Active Cash Card: Wells Fargo Active Cash Card Application

This guide provides a comprehensive overview of the Wells Fargo Active Cash Card application process, eligibility requirements, card features, security measures, customer support, and potential drawbacks. Understanding these aspects will help you make an informed decision before applying.

Application Process Overview, Wells fargo active cash card application

Source: wtupb.com

Applying for the Wells Fargo Active Cash Card is a straightforward process, available both online and in-person. The online application is generally faster and more convenient.

- Online Application: Visit the Wells Fargo website, locate the Active Cash Card application, and complete the online form. You’ll need to provide personal information, employment details, and financial information. The system will guide you through each step.

- In-Person Application: Visit a local Wells Fargo branch. A representative will assist you with the application and answer any questions you may have. You’ll need to bring the required documentation.

- Required Documentation: For both methods, you’ll typically need a government-issued ID, Social Security number, and proof of income (such as pay stubs or tax returns).

- Application Timeline: Online applications are usually processed faster, often within a few days. In-person applications may take a little longer, potentially up to a week or more.

| Feature | Online Application | In-Person Application |

|---|---|---|

| Convenience | High | Moderate |

| Speed | Faster | Slower |

| Accessibility | 24/7 | During branch hours |

| Personal Assistance | Limited | Available |

Eligibility Criteria

Source: stealthcapitalist.com

Meeting the eligibility criteria is crucial for approval. Wells Fargo assesses several factors to determine your creditworthiness.

- Credit Score: A good credit score is typically required. The exact minimum score may vary, but generally, a score above 670 is beneficial.

- Income Requirements: You’ll need to demonstrate a stable income to support the credit card payments. Wells Fargo will verify your income through documentation such as pay stubs or tax returns.

- Employment History: A consistent employment history adds to your eligibility.

- Credit History: A positive credit history with responsible credit management significantly improves your chances.

- Debt-to-Income Ratio: A lower debt-to-income ratio indicates a better ability to manage debt, increasing the likelihood of approval.

- Reasons for Rejection: Applications may be rejected due to low credit scores, insufficient income, or a history of missed payments.

Card Features and Benefits

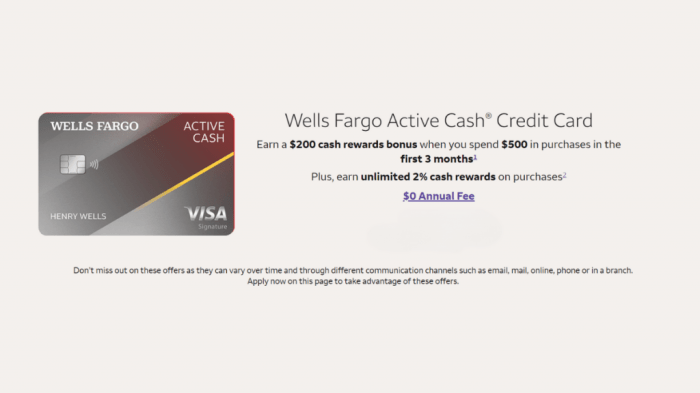

The Wells Fargo Active Cash Card offers a compelling rewards program and other valuable benefits.

The card boasts a competitive cashback rewards program, typically offering a flat percentage back on all purchases. There’s usually no annual fee, making it an attractive option for budget-conscious consumers. The cashback earned can be redeemed as a statement credit.

| Feature | Wells Fargo Active Cash Card | Competitor Card A (Example) | Competitor Card B (Example) |

|---|---|---|---|

| Cashback Rate | 2% (Example) | 1.5% (Example) | 1% (Example) |

| Annual Fee | $0 | $95 (Example) | $0 |

| Foreign Transaction Fee | (Check current details) | (Check current details) | (Check current details) |

Security and Fraud Protection

Wells Fargo employs robust security measures to protect your card and account information. They offer various fraud protection benefits to safeguard against unauthorized transactions.

Zero liability protection is usually offered, meaning you are not responsible for unauthorized charges. In case of a lost or stolen card, immediate reporting is crucial. Contact Wells Fargo customer service to report the loss and have the card deactivated. They will guide you through the process of replacing the card and securing your account.

Scenario: If fraudulent activity is detected on your account, Wells Fargo’s fraud monitoring system will typically flag the suspicious transactions. You will be contacted to verify the transactions, and the fraudulent charges will be reversed.

Security Tips: Regularly review your statements for any unusual activity. Protect your PIN and do not share your card information with anyone.

Customer Support and Resources

Source: financebuzz.com

Wells Fargo provides multiple channels for customer support, ensuring convenient access to assistance.

- Phone Support: Contact their customer service number available on their website.

- Online Support: Access FAQs, account management tools, and secure messaging through their website.

- Branch Support: Visit a local branch for in-person assistance.

FAQs: The Wells Fargo website provides a dedicated section for frequently asked questions about the Active Cash Card and its application process.

Potential Drawbacks and Considerations

While the Wells Fargo Active Cash Card offers many benefits, it’s essential to be aware of potential drawbacks.

The Wells Fargo Active Cash card application process involves a credit check and review of financial history. For those seeking alternative savings options, understanding the features and fees associated with various accounts is crucial; a review of customer experiences with CIT Bank Savings Connect, such as those found on cit bank savings connect reviews , can inform this decision.

Ultimately, choosing between the Wells Fargo card and other financial products depends on individual needs and financial goals.

The cashback rewards program may not be as lucrative as some other cards, especially for specific spending categories. The APR (Annual Percentage Rate) is an important factor to consider; compare it with other similar cards before applying. The card might not be suitable for individuals with poor credit history or those seeking a card with extensive travel benefits or other specialized rewards.

Wrap-Up

Securing the Wells Fargo Active Cash Card is more than just acquiring a credit card; it’s a step towards a brighter financial future. By understanding the application process, eligibility requirements, and the card’s numerous benefits, you’re empowered to make informed decisions. Remember, financial empowerment starts with knowledge and planning. Take control of your finances today, and unlock the potential of the Wells Fargo Active Cash Card.